The health insurance industry is evolving. A data-rich world is challenging traditional underwriting methods. A new paradigm, smart underwriting in health insurance, is emerging, leveraging Artificial Intelligence (AI) to revolutionize risk assessment and customer service.

Smart underwriting in health insurance upgrades conventional underwriting by combining responsive electronic applications with sophisticated computerized evaluations. That signifies a shift from manual, paper-based processes to intelligent, data-driven operations. The goal is to optimize operations, enhance risk assessment accuracy, and improve the customer experience, making underwriting faster and more precise.

This article will guide you through smart underwriting in health insurance, its advantages, core technologies, and an implementation roadmap. We will also discuss challenges and future trends in smart underwriting for health insurance, empowering insurers to transition confidently.

Ready to embark on your smart underwriting journey in health insurance? Contact SPsoft to explore how our AI expertise and experience can transform your operations!

The Shifting Landscape: Why Embrace Change Now?

The health insurance industry must embrace smart underwriting in health insurance. Traditional models are often slow, costly, and error-prone. Modern customers expect rapid, personalized digital services.

The volume of health data, including medical records and lifestyle information, is exploding. AI is essential to analyze this data effectively. AI in the health insurance market is projected for extraordinary growth, underscoring a broad industry movement towards intelligent automation.

Adopting smart underwriting in health insurance is a competitive necessity. Evolving customer expectations demand speed and personalization. InsurTech companies are already using AI for services like instant quotes. Traditional insurers relying on outdated manual processes will struggle. Therefore, embracing smart underwriting for health insurance is crucial.

The growth of AI in health insurance reflects a shift in how the industry uses data. Smart underwriting uses AI to analyze vast amounts of data for superior risk assessment. The industry is moving from reactive claims processing to proactive risk understanding and prevention—a “predict and prevent” model. Smart underwriting in health insurance is a key enabler of this transformation.

The Imperative for Smart Underwriting in Health Insurance

The call for change in health insurance underwriting stems from the limitations of traditional models and the advantages of a technology-driven approach. Understanding this “why” is vital for embracing smart underwriting in health insurance.

Beyond Traditional Limits: The Shortcomings of Old Underwriting Models

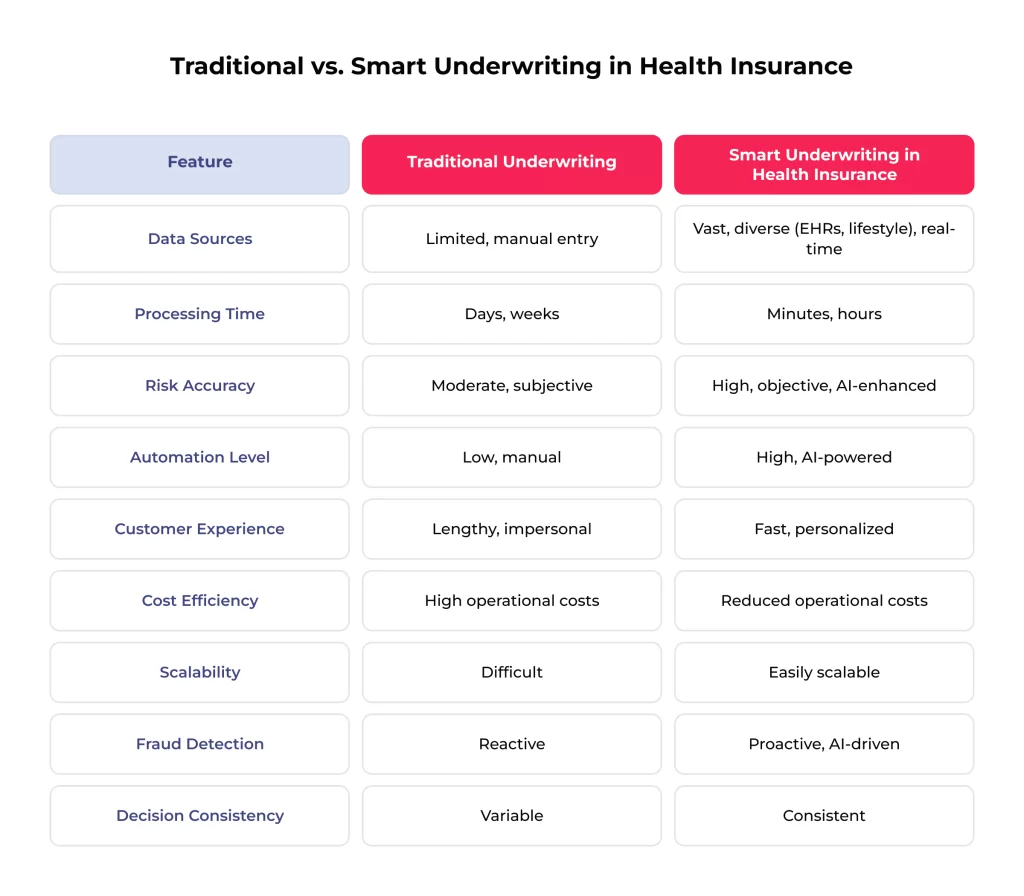

Traditional health insurance underwriting is increasingly outdated.

- Time-Consuming: Manual processes consume significant underwriter time.

- Inaccurate Risk Assessments: Limited data leads to less precise risk assessments.

- Inconsistent Decision-Making: Human subjectivity causes inconsistencies.

- Poor Customer Experience: Lengthy processes frustrate applicants.

The Transformative Benefits of Smart Underwriting for Health Insurance

Transitioning to smart underwriting for health insurance offers numerous benefits:

- Enhanced Operational Efficiency and Speed. AI automates tasks like data entry and initial screening, reducing processing times from days to minutes. Process orchestration streamlines workflows.

- Unprecedented Accuracy in Risk Assessment. Smart underwriting in health insurance uses AI and Machine Learning (ML) to analyze diverse datasets (medical records, lifestyle data). AI for health underwriting identifies complex patterns, leading to detailed, personalized risk evaluations and minimizing human error.

- Significant Cost Reductions and Improved Profitability. Automation lowers operational costs. Accurate risk assessment allows appropriate policy pricing, minimizing adverse selection and reducing claim losses.

- Elevated Customer Experience and Personalization. Faster approvals enhance satisfaction. AI in health insurance facilitates policies and pricing tailored to individual risk profiles.

- Proactive Fraud Detection and Mitigation. AI algorithms identify unusual patterns indicating fraud, protecting insurers from financial losses.

- Streamlined Regulatory Compliance. Smart underwriting in medical insurance aids compliance by systematically applying rules. AI tracks regulatory changes and ensures processes remain compliant.

Smart underwriting for health insurance allows insurers to shift to a proactive “predict and prevent” model. AI for health underwriting analyzes diverse data, offering insights for risk pricing and influencing health behaviors, potentially leading to fewer claims.

Improved accuracy and reduced bias in smart underwriting in medical insurance are crucial for trust and market viability, especially with increasing regulatory scrutiny. Fairness is vital for the sustainable adoption of AI in health insurance.

Core Techs Powering Smart Underwriting in Medical Insurance

Interconnected technologies drive the revolution in smart underwriting in medical insurance.

- AI for Health Underwriting: The Intelligent Core. AI is foundational. AI in health insurance enables systems to perform tasks requiring human intelligence. AI algorithms process complex datasets, uncovering hidden patterns and automating decision-making.

- Machine Learning (ML): Learning, Adapting, and Predicting. Machine Learning allows systems to learn from data. In smart underwriting for health insurance, ML applications include dynamic risk modeling, predictive capabilities, personalized pricing, and process optimization. Continuous learning improves accuracy.

- Natural Language Processing (NLP): Deciphering the Data Deluge. NLP enables computers to understand human language. NLP is crucial for smart underwriting in medical insurance as it extracts insights from unstructured data like EHRs and physicians’ notes, improving data quality.

- Predictive Analytics: Illuminating Future Risks and Opportunities. Predictive analytics uses algorithms and ML to forecast outcomes. It is central to smart underwriting in health insurance, enabling insurers to forecast health risks, identify high-risk individuals, optimize pricing, and enable proactive measures.

- Process Orchestration (PO): Harmonizing the Underwriting Workflow. Process Orchestration (PO) tools ensure technologies work seamlessly. PO platforms streamline end-to-end underwriting processes by integrating systems for data gathering, AI execution, and decision engines, enhancing efficiency and consistency.

The power of these technologies in smart underwriting for health insurance lies in their synergistic integration, orchestrated by PO. The shift from rule-based systems to ML-driven AI for health underwriting is fundamental, moving towards dynamic, predictive risk understanding. ML’s adaptability ensures smart underwriting in health insurance remains robust and relevant.

A Roadmap to Adopting Smart Underwriting in Health Insurance

Implementing smart underwriting in health insurance requires a strategic, phased approach.

Phase 1. Charting Your Course – Assessment and Strategy

- Evaluate Current Processes: Analyze existing workflows for bottlenecks and inefficiencies.

- Define Clear Objectives: Set SMART goals for smart underwriting in health insurance.

- Assess Data Readiness: Evaluate data quality, accessibility, and completeness.

- Develop a Strategic Vision: Formulate how AI in health insurance will transform underwriting.

Phase 2. Building the Bedrock – Data Infrastructure and Governance

- Invest in Data Infrastructure: Ensure IT can manage data for AI for health underwriting.

- Establish Data Governance: Implement policies for data quality, security, privacy, and compliance.

- Integrate Data Sources: Develop strategies to unify disparate data.

- Essential Data Governance Practices: Implement data quality checks, establish data ownership, enforce robust data security, ensure regulatory compliance.

Phase 3. Equipping for Success – Technology Selection and Integration

- Choose AI Platforms: Decide on off-the-shelf AI for health underwriting solutions, custom systems, or a hybrid.

- Develop Legacy System Integration Strategy: Plan integration with existing legacy systems.

- Plan for Model Management: Plan for ongoing AI model training, validation, and maintenance.

Phase 4. The Journey Unfolds – Phased Implementation and Agile Adaptation

- Start with Pilot Programs: Test solutions on a smaller scale.

- Iterative Rollouts: Gradually expand implementation based on pilot learnings.

- Monitor Performance: Continuously track KPIs.

- Be Agile and Adapt: Maintain an agile mindset.

Phase 5. Empowering Your People – Change Management and Skill Enhancement

- Communicate Vision and Benefits: Convey the importance of smart underwriting in health insurance.

- Provide Training: Equip staff with skills for new AI tools.

- Redefine Roles: Underwriter roles evolve to be more analytical and strategic.

- Foster a Data-Driven Culture: Cultivate a culture of data-driven decisions.

- Key Considerations for Smooth Transition: Strong leadership, clear communication, involve underwriters, celebrate successes, provide continuous support.

Successful smart underwriting in health insurance is a cultural shift. AI augments human expertise. Choosing between off-the-shelf and custom AI for health underwriting systems is strategic, impacting innovation and agility in smart underwriting in medical insurance.

Overcoming Challenges in Smart Underwriting Adoption

Adopting smart underwriting in health insurance presents several obstacles that organizations must navigate.

The Legacy System Labyrinth: Integrating Old and New

A significant hurdle in adopting smart underwriting is the integration with existing legacy IT systems. Common issues encountered include siloed data that is difficult to access and unify, a lack of modern APIs that would facilitate seamless data exchange, and insufficient processing capabilities in older systems to handle the demands of AI algorithms. Addressing this challenge requires careful planning, the potential use of middleware to bridge the gap between old and new systems, strategic data migration to more accessible platforms, and in some cases, a phased legacy infrastructure modernization.

Data Fortification: Ensuring Privacy and Security in Smart Underwriting in Medical Insurance

Handling sensitive Protected Health Information (PHI) with AI-powered smart underwriting demands the implementation of robust data privacy and security measures. Organizations must adhere strictly to regulatory obligations, such as complying with regulations like HIPAA in the United States. Introducing AI systems can also increase the potential attack surface for cyber threats. Key risks to mitigate include unauthorized data access, data breaches that can compromise patient confidentiality, and the potential for misuse of PHI by malicious actors.

Strategies for mitigating these risks involve implementing strong encryption protocols for data at rest and in transit, establishing stringent access controls based on roles and responsibilities, conducting regular and thorough security audits to identify vulnerabilities, employing data anonymization techniques to reduce the risk of re-identification, and carefully vetting AI vendors to ensure their security practices align with organizational standards.

The AI Ethics Tightrope: Mitigating Bias and Ensuring Fair Outcomes

The presence of bias in AI algorithms used for health underwriting can lead to unfair and discriminatory outcomes for individuals seeking insurance coverage. Sources of bias often stem from AI models trained on biased historical data, which can inadvertently perpetuate existing societal inequalities.

Effective mitigation strategies include careful and ethical model design, utilizing diverse and representative training datasets, monitoring the AI’s decision-making processes for potential bias, and implementing Explainable AI (XAI) techniques to understand and interpret the factors influencing the AI’s predictions. It is crucial to recognize that AI bias in smart underwriting in medical insurance is often linked to broader societal biases within healthcare data. Therefore, addressing this challenge requires technical solutions and a commitment to incorporating diverse perspectives and expertise in the AI development lifecycle.

The Human Factor: Augmenting Underwriters, Not Replacing Them

The introduction of AI in underwriting often raises concerns among human underwriters regarding potential job displacement. Addressing these fears requires clear and consistent communication that emphasizes the role of AI in health insurance as a tool to augment human expertise rather than replace it entirely. Investing in upskilling and reskilling programs is essential to train underwriters to effectively work with AI-powered tools, allowing their roles to evolve towards more strategic analysis and complex case management.

A hybrid approach, where AI handles routine and data-intensive tasks while human underwriters focus on complex cases that require nuanced judgment and empathy, is often the most effective model for integrating AI into underwriting workflows. Ultimately, overcoming the “human factor” challenge is deeply rooted in building trust. That requires actively involving underwriters in the implementation process, ensuring transparency in AI operations through XAI, and clearly articulating the synergistic role of collaboration between human intelligence and artificial intelligence.

Keeping Pace with Regulations for AI in Health Insurance

The regulatory landscape surrounding the use of AI in health insurance is continuously evolving. Organizations must stay informed about new and emerging guidelines, such as the National Association of Insurance Commissioners (NAIC) bulletin on AI models. Ensuring compliance requires a proactive focus on developing transparent AI systems in their operations, auditability to ensure accountability, fair decision-making processes, and, ultimately, accountability to regulatory standards.

Cost of Implementation

The initial investment required for implementing smart underwriting in health insurance can be substantial and represents a significant consideration for many organizations. Key investment areas include the acquisition and deployment of the necessary technology infrastructure, the establishment of robust data infrastructure to support AI algorithms, the often complex integration of AI tools with existing systems, the recruitment or upskilling of talent with expertise in both insurance and AI, and the effective management of organizational change associated with adopting new technologies.

However, the long-term return on investment (ROI) from smart underwriting is often compelling, driven by significant efficiency gains in underwriting processes and substantial reductions in operational costs. In many cases, the payback period for the initial investment can be short, sometimes estimated to be under 12 months, highlighting the potential for significant long-term financial benefits.

Navigating these multifaceted challenges effectively requires a proactive, strategic, and well-informed approach that considers the technological aspects of AI implementation and the ethical, regulatory, and human dimensions.

Future Trends Shaping Smart Underwriting for Health Insurance

The evolution of smart underwriting in health insurance is marked by exciting advancements paving the way for sophisticated and personalized practices.

Generative AI

Generative AI, particularly specialized Large Language Models (LLMs) tailored for the insurance sector, is poised to become a standard tool. These advanced models will enable the analysis of intricate policy language, the development of highly customized pricing strategies, the drafting of personalized communication, and the efficient summarization of complex medical records. That will enhance efficiency by streamlining document-intensive processes and facilitating more personalized policyholder interactions.

Hyper-Personalization

The proliferation of Internet of Things (IoT) devices and wearable technology will fuel an era of hyper-personalization in underwriting. Integrating real-time data streams from these devices will allow for a more granular and dynamic understanding of individual lifestyle and health habits.

While consumers are increasingly willing to share this data in exchange for tangible benefits such as personalized health promotion programs and potential premium discounts, this trend amplifies critical privacy and ethical considerations, necessitating the establishment of robust governance frameworks and ensuring complete transparency in data usage. This shift towards hyper-personalization in smart underwriting can transform insurer-customer relationships towards a more collaborative approach focused on wellness.

The Rise of Explainable AI (XAI)

The demand for Explainable AI (XAI) will experience significant growth as stakeholders seek greater clarity and understanding of AI-driven decisions in underwriting. XAI systems are designed to provide understandable explanations for AI outputs, which is crucial for ensuring fairness, maintaining regulatory compliance, and building trust among insurers and policyholders. Practical XAI techniques, such as LIME (Local Interpretable Model-agnostic Explanations) and feature importance scoring, will provide valuable insights into the reasoning behind AI model predictions, making the decision-making process more transparent and verifiable.

The convergence of sophisticated AI technologies like Generative AI and the increased adoption of XAI is critical for achieving the next level of efficiency and fostering greater trust in the application of AI for health underwriting, ultimately making advanced AI more acceptable and its outputs more readily verifiable.

Continuous Underwriting

The traditional static model of underwriting is evolving towards a continuous risk evaluation process. This shift involves leveraging real-time data streams from various sources to continuously monitor and reassess individual risk profiles throughout the policy lifecycle. This ongoing evaluation enables dynamic adaptation of policy terms or pricing based on significant changes in identified risk factors, allowing for more accurate and responsive risk management.

Enhanced Data Analytics and Engineering

The foundation of effective smart underwriting lies in high-quality data and robust data engineering practices. There will be a greater emphasis on ensuring data integrity through rigorous cleansing processes and using unbiased training datasets for AI models. Consequently, we will see increased investment in advanced data pipelines designed to support the complex data requirements of smart underwriting in health insurance.

Successfully navigating these trends will require strategic preparation, including investing in data science talent with AI and insurance principles expertise. Such trends collectively point towards a future where smart underwriting in health insurance becomes significantly more intelligent, highly personalized, and proactively engaged in risk management.

Conclusion

Adopting smart underwriting for health insurance, powered by AI, ML, and NLP, offers benefits like improved efficiency, accurate risk assessment, cost reductions, and enhanced customer experience. The future of health insurance underwriting is intelligent and data-driven. Embracing this is a strategic imperative, requiring a clear vision, robust data governance, careful technology selection, agile implementation, and workforce empowerment.

The “journey” to smart underwriting in health insurance is ongoing. As AI evolves, “smart” will be redefined. Trends like Generative AI and IoT data integration will push boundaries in AI for health underwriting, requiring perpetual learning and agility.

Finally, the success of smart underwriting in health insurance will also be measured by its contribution to a more equitable healthcare system. Improved accuracy and reduced bias can lead to fairer access to coverage. The “predict and prevent” model can positively impact population health. Insurers embarking on this journey with a clear strategy will thrive.

Take the next step towards smart underwriting in health insurance. Contact us to learn how our advanced AI agents can help you increase customer satisfaction!

FAQ

What exactly is smart underwriting in health insurance?

Smart underwriting in health insurance uses AI and ML to make risk assessment faster and more accurate. Unlike traditional manual methods, it automates tasks and analyzes diverse data for precise, personalized decisions.

Is AI going to replace health insurance underwriters?

AI is expected to augment, not replace, human underwriters. AI handles routine tasks, freeing underwriters for complex cases and strategic decisions.

How quickly can I see a return on investment (ROI) from implementing smart underwriting for health insurance?

ROI varies, but benefits like reduced processing times and lower costs can appear quickly. Some analyses suggest payback in under 12 months.

What’s the biggest mistake companies make when adopting AI for health underwriting?

Common pitfalls include underestimating data quality, failing to manage change and upskill staff, or lacking a clear strategic vision.

How does smart underwriting in medical insurance handle data privacy and security for sensitive health information?

It must comply with regulations like HIPAA, using robust security (encryption, access controls) and data anonymization.

Can AI really eliminate bias in health insurance underwriting?

AI can reduce human bias if designed carefully but can perpetuate biases from historical data. Mitigation requires diverse data, fairness testing, and ethical AI principles.

What kind of data is used in smart underwriting in health insurance?

It uses structured (EHRs, claims) and unstructured (physician’s notes, lifestyle) data, increasingly including data from wearables.

How can smart underwriting improve the experience for our customers?

Customers get faster processing, more intuitive applications, and tailored policy offerings, leading to a fairer experience.

What are the first practical steps my company should take to explore AI in health insurance for underwriting?

Assess current processes, define AI objectives, evaluate data readiness, educate your team, and consider a pilot project.

How will techs like GenAI and IoT change health underwriting in the next few years?

Generative AI will automate complex document analysis. IoT will provide continuous health data for hyper-personalized risk assessment and dynamic policies.