The insurance industry is built on a single, fundamental promise: to provide financial protection in a time of need. Yet, for decades, the claims process of fulfilling that promise has been notoriously slow, cumbersome, and opaque. Policyholders face lengthy paperwork, multiple points of contact, and uncertain timelines, while insurers grapple with staggering operational costs, the constant threat of fraud, and the risk of human error. This friction-filled model is no longer sustainable in a world accustomed to instant gratification and digital experiences.

The catalyst for change has arrived, powered by data and artificial intelligence. The transition from manual, intuition-based decisions to data-driven, automated workflows is a complete revolution. At the heart of this transformation is insurance claims analytics software — a sophisticated ecosystem of technologies designed to ingest, analyze, and act on vast amounts of data with unprecedented speed and accuracy.

This article provides a deep exploration of how AI insurance claims are reshaping the industry. We will dissect the core capabilities of modern AI platforms, from intelligent data extraction to predictive fraud detection, and quantify the profound benefits for both insurers and their clients. We will also examine real-world applications across various insurance lines and address the critical challenges and ethical considerations that accompany this tech leap. Ultimately, the question is no longer whether AI will dominate claims processing, but how quickly organizations can adapt to a new paradigm where decisions are made with intelligence, speed, and fairness.

Is your claims workflow held back by outdated systems and manual processes? SPsoft specializes in developing custom AI claims analytics software designed to seamlessly integrate with your existing infrastructure!

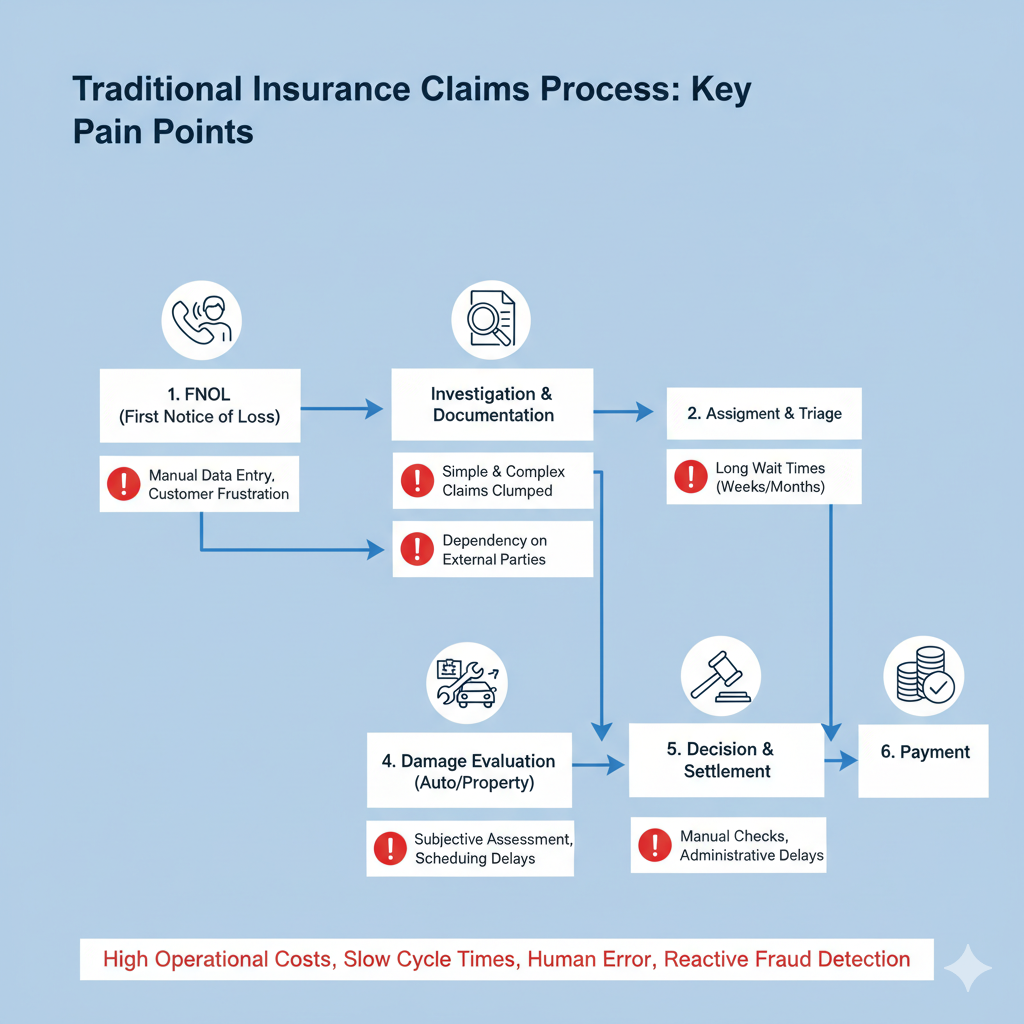

The Anatomy of a Traditional Claims Management Process

To appreciate the scale of the AI-driven revolution, one must first understand the legacy system it is replacing. The traditional claims lifecycle is a multi-stage, labor-intensive journey fraught with potential bottlenecks.

- First Notice of Loss (FNOL). The process begins when a policyholder reports an incident, typically by phone. That requires a call center agent to collect and enter information into a core system manually. This step is prone to data entry errors and can be a point of frustration for a customer already in distress.

- Assignment and Triage. The claim is assigned to an adjuster. This assignment is often based on simple factors like geography or workload, not necessarily the adjuster’s specific expertise or the claim’s complexity. Simple, low-value claims often follow the same initial path as highly complex ones, wasting valuable resources.

- Investigation and Documentation. The adjuster manually gathers evidence. That can involve reviewing policy documents, collecting police reports, requesting medical records, communicating with third parties, and scheduling in-person inspections. This phase can stretch for weeks or even months, depending on the responsiveness of multiple external parties and the adjuster’s capacity.

- Damage Evaluation. For property and auto claims, an appraiser must often physically inspect the damage to estimate repair costs. That introduces scheduling delays and subjective judgments that can lead to inconsistent valuations.

- Decision and Settlement. Based on the collected evidence and their own experience, the adjuster decides on liability and the settlement amount. This human judgment, while valuable, can be inconsistent across adjusters, leading to potential disputes and customer dissatisfaction.

- Payment. Once a settlement is agreed upon, the payment process is initiated, often involving manual checks and further administrative delays.

This entire process is characterized by high operational costs (salaries, administrative overhead), slow cycle times, a high potential for human error, and a reactive approach to fraud. Fraud is often only detected after payment, making recovery difficult.

The Paradigm Shift: What Is AI-Powered Insurance Claims Analytics Software?

Insurance claims analytics software represents a fundamental shift from a process-driven to a data-driven model. It is not a single tool but an integrated suite of technologies that leverage artificial intelligence to optimize and augment every stage of the claims lifecycle. The goal is to make the process faster, more accurate, and more efficient.

The key technological pillars of AI in claims management include:

- Machine Learning (ML). ML algorithms are the “brain” of the system. They are trained on vast historical datasets of claims to identify data patterns, predict outcomes, and make decisions. That is crucial for fraud detection, predicting claim severity, and determining the likelihood of litigation.

- Natural Language Processing (NLP). Insurance is built on unstructured data, including adjuster notes, emails, medical reports, legal documents, and client communications. NLP enables machines to read, understand, and extract critical information from this text, converting it into structured data that can be analyzed.

- Computer Vision. This technology allows AI to “see” and interpret images and videos. In AI applications in the auto insurance market, it can analyze photos of a damaged vehicle to instantly assess the extent of the damage and estimate repair costs. In property insurance, it can analyze drone footage of a storm-damaged roof.

- Robotic Process Automation (RPA). RPA bots are designed to handle repetitive, rules-based tasks that previously required human intervention. That includes tasks like data entry, file creation, sending standardized email updates, and processing payments, freeing up human adjusters to focus on more complex, value-added work.

- Predictive Analytics. By combining these techs, the software forecasts future events. It can predict the total cost (reserve) of a claim early on, identify which claims are likely to become complex or litigious, and flag potentially fraudulent activity before it escalates.

These technologies work in concert to create a seamless, intelligent workflow, turning the claims department into a strategic asset for customer retention and profitability.

Core Capabilities: How AI Automated Claims Management Works

Modern AI claims solutions are transforming the workflow with a set of powerful, integrated capabilities. These functions directly address the pain points of the traditional process.

Intelligent First Notice of Loss (FNOL) and Triage

The claim journey begins with a smarter intake. AI-powered chatbots and mobile apps can guide customers through the FNOL process 24/7. Using NLP, they can understand the customer’s description of the event, ask relevant clarifying questions, and instantly upload photos or documents. The system then automatically analyzes this initial data to:

- Verify Coverage. Instantly check the customer’s policy to confirm coverage for the reported event.

- Triage and Route. Assess the claim’s complexity based on keywords, loss type, and initial damage indicators. Simple claims can be flagged for “fast-track” or straight-through processing (STP), while complex cases are immediately routed to a specialized senior adjuster.

Automated Data Extraction and Validation

A significant portion of an adjuster’s time is spent manually reading documents and keying in data. Artificial intelligence claims processing automates this entirely. Using Optical Character Recognition (OCR) and NLP, the software can scan and “read” a wide range of documents:

- Police accident reports

- Medical bills and records (e.g., CPT codes)

- Invoices from repair shops

- Legal correspondence

The AI extracts relevant data points (names, dates, policy numbers, injury descriptions, cost figures) and populates them into the core claims system, validating the information for accuracy and completeness as it goes.

Advanced AI-Driven Fraud Detection

Fraud costs the insurance industry tens of billions of dollars annually. AI provides a proactive defense. Instead of relying on adjusters to spot “red flags,” ML models continuously scan all incoming data for suspicious patterns that are often invisible to human eyes. Methods include:

- Anomaly Detection. Flagging claims that deviate significantly from the norm (e.g., a minor fender-bender resulting in unusually high medical bills).

- Network Analysis. Identifying hidden relationships between claimants, medical providers, and repair shops to uncover organized fraud rings.

- Text Mining. Analyzing adjuster notes and claimant statements for suspicious language or sentiment.

- Image Forensics. Detecting if photos submitted as evidence have been digitally altered.

That allows insurers to flag and investigate suspicious AI insurance claims in real time, preventing fraudulent payouts.

Instant Damage Assessment with Computer Vision

In auto and property insurance, computer vision is a game-changer. A policyholder can take photos or a video of the damage with their smartphone. The AI model, trained on millions of images of vehicle and property damage, can:

- Identify the affected parts of the vehicle or structure.

- Assess the severity of the damage (e.g., scratch, dent, tear, complete replacement).

- Cross-reference parts databases and local labor rates.

- Generate a detailed repair cost estimate within seconds.

That eliminates the need to wait for a field appraiser, shortening the time to settlement for a significant portion of claims. That is a key driver in the AI in the auto insurance market.

AI and Predictive Analytics for Reserving and Litigation

Setting accurate financial reserves (the money set aside to pay for a claim) is a critical financial function for an insurer. AI models can analyze thousands of data points from the outset of a claim to predict its likely final cost with far greater accuracy than a human. Furthermore, the models can identify claims with a high probability of escalating into litigation, allowing the insurer to intervene early with specialized resources to seek a faster, more amicable claims resolution.

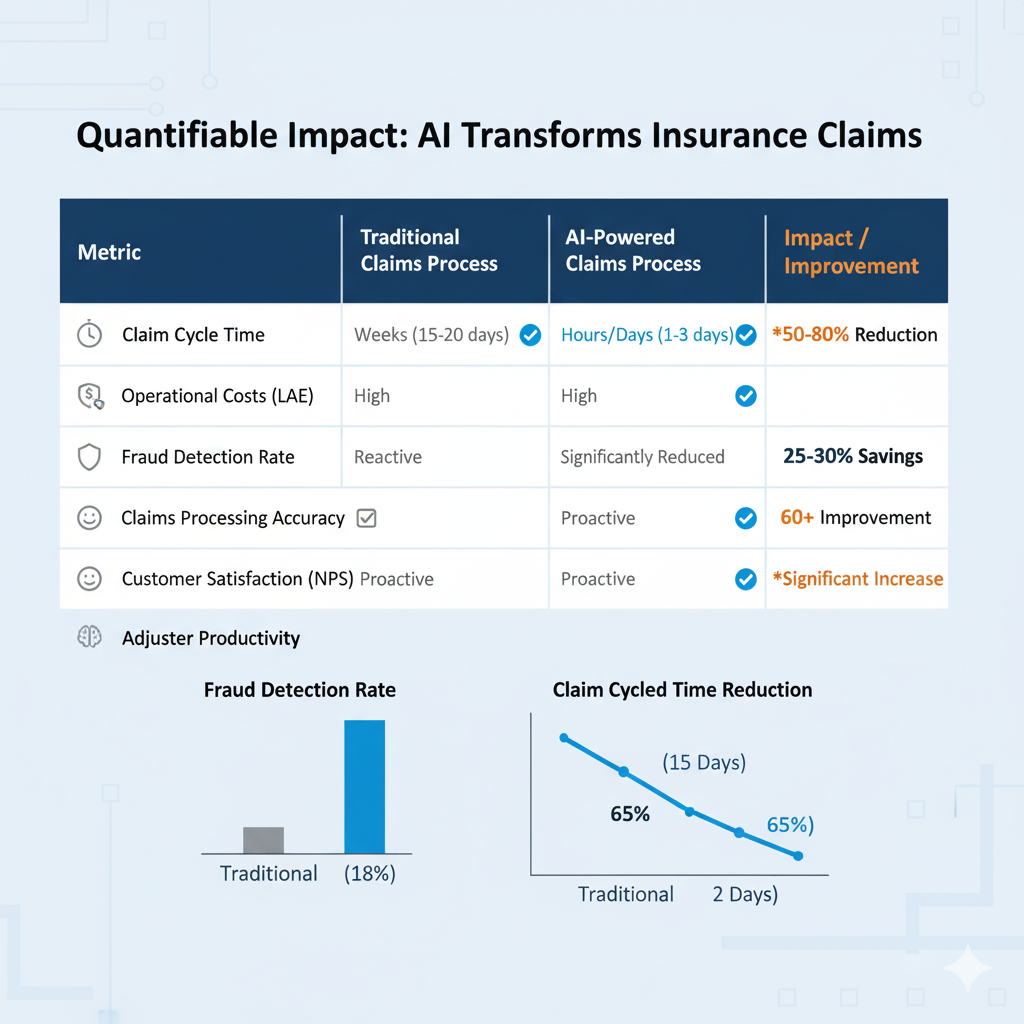

Quantifiable Impact: The Benefits of AI in Insurance

The adoption of AI in claims processing is about delivering measurable results across the board.

- Drastically Reduced Cycle Times. What once took weeks can now take hours or even minutes. Automated data intake and damage assessment can result in settlement offers for simple claims before the policyholder has even left the scene of the accident. That leads to a 50-80% reduction in claim cycle times for certain claim types.

- Lowered Operational Costs. By automating repetitive administrative tasks, insurers can reduce their Loss Adjustment Expense (LAE) by 25-30%. RPA bots can handle the work of multiple full-time employees, and AI-driven triage ensures that expensive human expertise is only used where it’s most needed.

- Improved Accuracy and Consistency. AI models apply the same logic to every claim, removing the subjectivity and variability of human decision-making. That leads to more consistent and fair outcomes, reducing the likelihood of disputes and litigation.

- Enhanced Fraud Detection. AI in insurance claims statistics show that AI can improve fraud detection rates by over 60%. By moving from a “pay and chase” model to a “predict and prevent” model, insurers save billions in fraudulent payouts.

- Superior Customer Experience. In today’s market, customer experience is a key differentiator. Faster settlements, proactive communication via AI-powered alerts, and 24/7 accessibility through chatbots dramatically increase customer satisfaction (NPS) scores and improve retention rates.

- Empowered Adjusters. By freeing adjusters from mundane paperwork and data entry, AI in claims management allows them to function as true risk experts. They can now focus their time on the most complex, nuanced cases and on providing empathetic customer service during difficult times.

After all, the mentioned above benefits of AI in insurance are profound and multifaceted.

AI in Action: Real-World Applications Across Insurance Lines

The application of insurance claims analytics software varies depending on the unique challenges of each insurance sector.

- Auto Insurance. This is a leading area for AI adoption. Telematics data from a driver’s vehicle can automatically trigger a claim upon impact (eFNOL), providing rich data on speed, braking, and location. As mentioned, photo-based damage estimation via computer vision is becoming standard for fast-tracking repairs.

- Property and Casualty (P&C) Insurance. After a natural disaster such as a hurricane or wildfire, AI can analyze satellite and drone imagery to rapidly assess the extent of damage across thousands of properties simultaneously. That allows insurers to triage claims, allocate resources effectively, and get funds to affected policyholders faster.

- Health Insurance. That is one of the most complex areas due to the volume and sensitivity of data. AI in claims processing helps by automatically reading medical records, identifying billing codes, and flagging duplicate or fraudulent claims from providers. NLP can also help automate the prior authorization process, a major pain point for both patients and providers.

- Workers’ Compensation. AI models can analyze incident reports and initial medical diagnoses to predict injury severity, the likely duration of time off work, and the optimal treatment path. That helps employers and insurers proactively manage the case to ensure the best outcome for the injured employee while controlling costs.

These diverse applications demonstrate that AI in claims is a versatile solution, custom-fit to the unique data and risks of insurance lines. This adaptability is precisely what makes its impact so profound and widespread across the industry.

Navigating the Hurdles: Challenges and Ethical Considerations

While the potential of AI automated claims management is immense, the path to implementation is not without its challenges.

- Data Privacy and Security. Claims data is highly sensitive and contains personal, financial, and medical information. Insurers must ensure their AI systems comply with regulations like GDPR and CCPA and are fortified against cyber threats.

- The “Black Box” Problem. Some advanced ML models are so complex that even their creators cannot fully explain the specific reasoning behind a particular decision. This lack of transparency can be a problem for regulators and for explaining an adverse decision (like a denied claim) to a customer. A focus on “Explainable AI” (XAI) is crucial to overcome this.

- Algorithmic Bias. If an AI model is trained on historical claims data that contains inherent human biases, the AI will learn and potentially amplify those biases. For example, if past data shows adjusters unconsciously awarded lower settlements in specific zip codes, the AI perpetuates this discriminatory practice. Rigorous testing and bias-auditing are vital.

- Implementation and Integration. Integrating a new insurance claims data analytics software platform with legacy core systems can be complex and expensive. It requires significant investment in technology and talent.

- The Human Factor. There is a natural concern about job displacement. The successful adoption of AI requires a commitment to upskilling the existing workforce, retraining adjusters to become data-savvy portfolio managers who oversee AI decisions and handle complex, empathy-driven interactions.

Successfully addressing these hurdles is therefore a strategic imperative. It’s essential to build a system that is fair, transparent, and trusted by both regulators and customers.

The Horizon: The Future of AI in Insurance Claims

The evolution of AI in claims is far from over. The next wave of innovation promises an even more integrated and proactive future.

- Hyper-Personalization. Claims experiences will be tailored to the individual. An AI might detect a stressed tone in a customer’s voice during the FNOL call and automatically route them to a specialized empathy-trained agent.

- Generative AI. Tools like ChatGPT will be used to automatically generate claim summaries, customer correspondence, and settlement letters in clear, empathetic language, further boosting efficiency.

- Proactive and Preventive Models. The future is not just about processing claims faster but preventing them altogether. Data from IoT sensors in smart homes (detecting a water leak) or smart cars (predicting brake failure) could trigger proactive maintenance alerts, preventing a loss event from ever occurring.

- Integrated Ecosystems. AI claims solutions will not operate in a vacuum. They will be seamlessly connected to external ecosystems. For example, after a car accident, the AI not only assesses the damage but also automatically schedules a tow truck, books a rental car, and orders the necessary parts at a pre-approved repair shop within minutes.

This evolution signals a fundamental shift for the industry, moving it from a reactive payer of claims to a proactive partner in risk prevention. The future of claims is about seamlessly managing the entire incident lifecycle and even preventing it from occurring in the first place.

Conclusion: From Administrator to Innovator

The insurance claims department is undergoing its most significant transformation in a century. Thus, the adoption of artificial intelligence is moving the function from a reactive administrative backwater to a proactive, data-driven engine of customer satisfaction and business value. Such a journey is complex, requiring strategic investment, a focus on ethical implementation, and a commitment to workforce evolution.

However, the conclusion is undeniable. Insurance claims analytics software is the critical infrastructure for the modern insurer. By leveraging AI to automate processes, uncover deep data insights, and make faster, fairer decisions, insurance companies can finally deliver on their core promise with the speed, transparency, and empathy that today’s customers demand. The carriers that embrace this change will lead the industry into a more customer-centric future.

Go beyond off-the-shelf solutions. We partner with you to build bespoke AI engines and intelligent agents that turn your claims data into a source of competitive advantage. From predictive modeling to custom models, let’s build the innovative platform that will define your future!

FAQ

How does AI actually make the insurance claims process faster?

AI accelerates claims by automating the most time-consuming manual tasks. Instead of waiting for an adjuster, insurance claims analytics software uses AI for instant data intake (FNOL), extracts information from documents using NLP, and assesses damage from photos using computer vision. That allows simple claims to be processed in minutes or hours, not weeks. This rapid, automated insurance workflow significantly reduces cycle times, getting settlement offers to policyholders faster than ever before.

Will AI completely replace human insurance claims adjusters?

No, the goal of AI in claims management is to augment their abilities. AI handles the repetitive, data-heavy tasks like paperwork and initial assessments, freeing up human experts to focus on complex, high-stakes cases that require empathy, negotiation, and nuanced judgment. Adjusters will evolve into portfolio managers who oversee AI decisions and manage the most critical customer interactions, thereby making their roles more strategic.

How can AI detect insurance fraud more effectively than a person?

AI excels at identifying complex, hidden patterns in vast datasets that are invisible to the human eye. AI claims solutions use machine learning to analyze claim details, claimant history, and provider networks to flag suspicious connections and anomalies. For example, it can detect organized fraud rings or an unusually high number of claims from a specific medical provider. This proactive, AI-driven claims analysis stops fraud before payouts occur, making it far more effective than traditional reactive methods.

Can an AI be biased when deciding on a claim settlement?

Yes, this is a critical ethical consideration. Suppose the historical data used to train an AI model contains past human biases (e.g., unconsciously offering lower settlements in certain neighborhoods). In that case, the AI can learn and even amplify those unfair patterns. Reputable firms combat this by conducting rigorous bias audits on their algorithms and focusing on “Explainable AI” (XAI). That ensures that the artificial intelligence claims processing models make decisions that are not only accurate but also transparent and fair.

What is the main role of computer vision in the AI auto insurance market?

In the AI-driven auto insurance market, computer vision is a game-changer for damage assessment. A policyholder can upload photos of their damaged vehicle via a mobile app. The AI model, trained on millions of images, can instantly identify which parts are damaged, assess the severity (e.g., scratch vs. full replacement), and generate a detailed repair cost estimate within seconds. That eliminates the delays associated with scheduling an in-person inspection from a human appraiser.

How does this advanced analytics software benefit me as a policyholder?

The primary benefits of AI in insurance for a policyholder are speed, transparency, and an improved customer experience. Your claim gets resolved much faster, often with a settlement in days or even hours. You receive proactive, automated updates, so you are always informed about the status of your claim. By making the process more efficient and accurate, AI in insurance claims removes much of the stress and uncertainty typically associated with making a claim, leading to higher satisfaction.

Is my personal data safe when an AI is processing my claim?

Protecting sensitive data is a top priority. Modern insurance claims analytics software is built with robust security protocols to comply with strict regulations like GDPR and CCPA. All personal, financial, and medical data is encrypted and handled within secure environments. While AI processes the data to make decisions, strong cybersecurity measures are in place to fortify the system against breaches, ensuring your confidential information remains protected throughout the automated claims lifecycle.