The health insurance landscape is undergoing a seismic shift. The industry has grappled with complex processes for years, often leading to frustrating customer experiences. Policyholders frequently face confusing jargon, lengthy claims procedures, and impersonal interactions. However, a powerful catalyst for change has emerged: Artificial Intelligence (AI). The drive to enhance customer experience in health insurance is no longer a mere aspiration but a critical business imperative. As technology continues to evolve, the question isn’t whether AI will reshape the sector, but how profoundly and quickly.

This transformation is evident in how insurers approach customer experience in health insurance, aiming for more personalized, efficient, and empathetic interactions. Integrating AI in health insurance is paving the way for a new era where customer satisfaction and operational excellence go hand in hand. For providers looking to stay competitive and truly serve their members, understanding and leveraging AI for health insurance is becoming non-negotiable.

Ready to elevate your customer experience in health insurance with cutting-edge AI solutions? SPsoft has proven expertise in developing and integrating sophisticated healthcare AI agents. Contact us today!

The Current State of Customer Experience in Health Insurance

Pain points have often characterized the traditional customer experience in health insurance. These issues lead to dissatisfaction, which can result in member churn and damage to an insurer’s reputation. Understanding these challenges is the first step towards appreciating AI’s transformative potential in health insurance.

Common Frustrations for Policyholders

Navigating the world of health insurance can feel daunting for many. Policyholders often encounter:

- Complex Policy Language. Insurance documents are notoriously difficult to understand, filled with technical terms and convoluted clauses. This lack of clarity can lead to misunderstandings about coverage and benefits.

- Lengthy and Opaque Claims Processes. Filing a claim and waiting for its resolution is frequently a source of anxiety. Delays, lack of transparency in the process, and unexpected rejections contribute significantly to a negative customer experience in health insurance.

- Generic, One-Size-Fits-All Communication. Members often receive standardized communications that don’t address their specific needs or circumstances. This impersonal approach makes them feel like just another number.

- Difficulty Accessing Information. Finding clear answers to specific questions about coverage, providers, or claim status can be time-consuming and frustrating, often involving long wait times on customer service calls.

- Reactive Rather Than Proactive Service. Many interactions with health insurance providers occur only when there’s a problem. A lack of proactive outreach, wellness reminders, or personalized advice contributes to a transactional dynamic.

These issues collectively contribute to a suboptimal customer experience in health insurance, highlighting a significant opportunity for improvement. The demand for a more intuitive, responsive, personalized service model is growing louder.

Why Is Superior Customer Experience in Health Insurance So Critical?

In today’s competitive market, customer experience in health insurance has become a key differentiator. Simply offering a good range of plans is no longer enough. Insurers must now focus on building lasting relationships with their members, founded on trust and satisfaction.

- Member Retention. A positive experience makes members more likely to renew their policies. High churn rates are costly, and improving customer experience in health insurance is a direct way to combat this.

- Brand Loyalty and Advocacy. Satisfied customers become brand advocates, recommending their insurer to friends and family. This organic marketing is invaluable.

- Competitive Advantage. Insurers that prioritize and successfully enhance customer experience in health insurance will stand out from the competition.

- Regulatory Scrutiny. Regulators are increasingly focusing on fair treatment of customers and transparency. A strong focus on customer experience can help meet these evolving standards.

- Operational Efficiency. Streamlining processes to improve the customer journey often leads to internal efficiencies and cost savings for the health insurance provider.

The imperative to elevate the customer experience in health insurance is clear. Traditional methods are failing, and this is precisely where AI’s capabilities in health insurance can make a monumental difference.

Reshaping Customer Experience in Health Insurance with AI

Artificial Intelligence is a collection of powerful technologies capable of fundamentally changing how health insurance companies operate and interact with their members. From streamlining backend processes to personalizing every touchpoint, AI in health insurance offers a pathway to a vastly improved customer experience.

Understanding AI’s Role in the Health Insurance Sector

AI in health insurance encompasses a range of technologies, including machine learning (ML), natural language processing (NLP), robotic process automation (RPA), and predictive analytics. These tools can analyze vast amounts of data, automate repetitive tasks, understand and respond to human language, and predict future trends or individual member needs.

The primary goal of deploying AI for health insurance in the context of customer experience is to make interactions:

- More Personalized. Tailoring advice, recommendations, and communications to individual member profiles and needs.

- More Efficient. Speeding up processes like claims handling, underwriting, and query resolution.

- More Accessible. Providing 24/7 support through AI-powered chatbots and virtual assistants.

- More Proactive. Identifying potential health risks or member needs before they escalate.

By addressing policyholders’ core frustrations, AI in health insurance can significantly improve the overall customer experience.

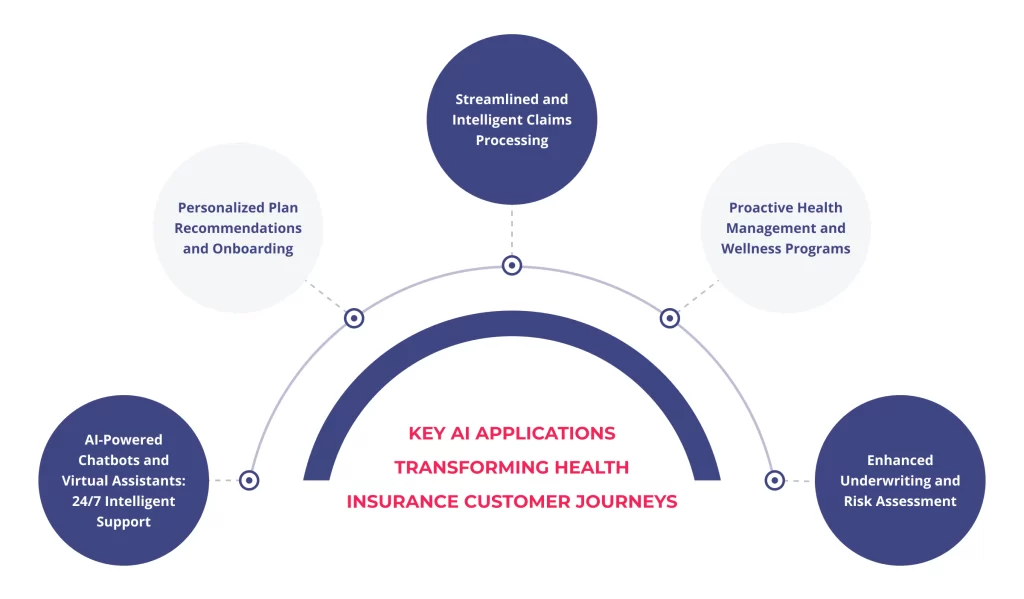

Key AI Applications Transforming Health Insurance Customer Journeys

The applications of AI for health insurance are diverse and impact virtually every stage of the customer lifecycle. Each application directly contributes to a better customer experience in health insurance.

AI-Powered Chatbots and Virtual Assistants: 24/7 Intelligent Support

One of the most visible applications of AI in health insurance is chatbots and virtual assistants. These tools are revolutionizing how members get information and support.

- Instantaneous Responses. AI chatbots can provide immediate answers to frequently asked questions about policy details, coverage, network providers, and claim status, eliminating frustrating wait times. That directly improves the customer experience in health insurance by offering quick resolutions.

- 24/7 Availability. Unlike human agents, AI assistants are available around the clock, providing support whenever members need it, regardless of time zones or business hours.

- Handling High Volumes. Chatbots can manage many queries simultaneously, especially during peak times or crises.

- Natural Language Processing (NLP). Advanced NLP capabilities allow these bots to understand and respond to queries in a conversational and human-like manner, enhancing the customer experience in health insurance.

- Escalation to Human Agents. When a query is too complex or requires empathy beyond the bot’s capabilities, it can be seamlessly escalated to a human agent, with the AI providing context for a smoother handover.

For instance, a member wondering about coverage for a specific procedure can ask an AI chatbot and receive an accurate, policy-specific answer within seconds, a vast improvement on traditional call center experiences. It is a prime example of AI directly enhancing member satisfaction for health insurance.

Personalized Plan Recommendations and Onboarding

Choosing the right health insurance plan can be overwhelming. AI in health insurance can simplify this crucial first step and ensure a smoother onboarding process, setting a positive tone for the entire customer experience in health insurance.

- Data-Driven Insights. AI algorithms can analyze a potential member’s demographic data, health status, lifestyle, and financial situation (with consent) to recommend the most suitable plans.

- Interactive Tools. AI-powered tools can guide applicants through a series of questions, explaining options in simple terms and helping them compare plans effectively.

- Tailored Onboarding. Once a plan is selected, AI can personalize the onboarding process, providing relevant information, tutorials on using member portals, and proactive tips for maximizing their benefits. This thoughtful approach significantly boosts the initial customer experience in health insurance.

Imagine a system that asks a few simple questions and then presents the top three plan options ideally suited to an individual’s unique needs, along with a clear breakdown of why each is a good fit. This level of personalization, driven by AI for health insurance, transforms a potentially stressful decision into a positive interaction.

Streamlined and Intelligent Claims Processing

The claims process is often the most critical touchpoint and, historically, a significant source of frustration in health insurance. AI in health insurance is bringing unprecedented efficiency and transparency to this area.

- Automated Claims Adjudication. AI can automate the review of straightforward claims, checking for completeness, policy compliance, and potential fraud much faster than manual processes. That speeds up reimbursement and improves the customer experience in health insurance.

- Fraud Detection. Sophisticated AI algorithms can identify patterns and anomalies indicative of fraudulent claims, reducing insurers’ losses and ensuring fair premiums for honest members. While this is an internal benefit, it contributes to overall system integrity, indirectly benefiting the customer experience in health insurance.

- Real-Time Status Updates. AI-powered systems can provide members with real-time updates on their claim status via portals or mobile apps, reducing anxiety and the need for follow-up calls.

- Intelligent Document Processing. AI can quickly and accurately extract and process information from various claim-related documents (medical reports, invoices).

Faster, more transparent claims processing is a cornerstone of a better customer experience in health insurance. When members receive their reimbursements quickly and are kept informed, their trust in the insurer grows.

Proactive Health Management and Wellness Programs

AI for health insurance enables a shift from reactive care to proactive health management, a significant value-add for members and a powerful way to enhance customer experience in health insurance.

- Personalized Wellness Recommendations. AI can analyze wearable device data, health records (with consent), and lifestyle information to provide personalized diet, exercise, and preventive care tips.

- Early Risk Detection. Machine learning models can identify individuals at higher risk for certain chronic conditions, allowing insurers to offer targeted interventions and support programs.

- Medication Adherence Reminders. AI-powered apps can send reminders for medication, appointments, and health screenings, helping members stay on track with their health goals.

- Gamified Wellness Challenges. AI can support engaging wellness programs and encourage healthy behaviors through gamification and personalized feedback.

When a health insurance provider actively helps its members stay healthier, the relationship transforms from a purely financial one to a partnership in well-being. This proactive approach dramatically improves the customer experience in health insurance.

Enhanced Underwriting and Risk Assessment

While less directly visible to the customer, accurate underwriting is crucial for fair pricing and the long-term stability of a health insurance provider. AI in health insurance makes this process more efficient and precise.

- Faster Policy Issuance. AI can analyze applicant data from various sources to assess risk and determine premiums more quickly, reducing policy issuance waiting times. This initial efficiency contributes positively to the customer experience in health insurance.

- More Accurate Risk Profiling. Machine learning algorithms can identify complex patterns in data that human underwriters might miss, leading to more accurate risk assessments and fairer pricing.

- Reduced Manual Effort. Automating data collection and initial analysis frees human underwriters to focus on more complex cases requiring nuanced judgment.

A smoother, faster application and underwriting process, facilitated by AI for health insurance, creates a positive first impression and sets the stage for a better ongoing customer experience in health insurance.

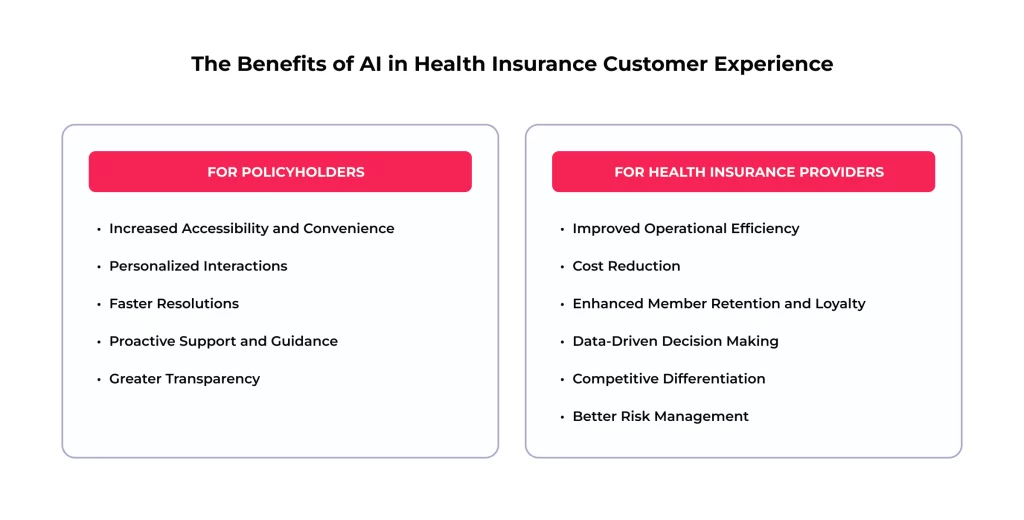

The Benefits of AI in Health Insurance Customer Experience

Adopting AI in health insurance brings many benefits, not just for the customers, but also for the insurance providers themselves. These advantages work synergistically to elevate the entire ecosystem. Improving the customer experience in health insurance through AI is a win-win.

For Policyholders: A More Empathetic and Efficient Journey

- Increased Accessibility and Convenience. 24/7 support via chatbots, easy access to information through mobile apps, and self-service options empower members and fit their busy lifestyles. This focus on accessibility is key to a modern customer experience in health insurance.

- Personalized Interactions. Giving advice, planning recommendations, and health tips tailored to their needs makes members feel understood and valued. This personalization transforms the customer experience in health insurance from generic to individual.

- Faster Resolutions. Quicker claims processing, instant answers to common questions, and streamlined administrative tasks reduce waiting times and frustration. Efficient processes are fundamental to a good customer experience in health insurance.

- Proactive Support and Guidance. Receiving alerts about potential health risks or reminders for preventive care shows that the insurer cares about the customer’s well-being, not just their premiums. This proactive stance significantly enhances the customer experience in health insurance.

- Greater Transparency. More precise explanations of policy terms, real-time updates on claims, and easy-to-understand benefit summaries demystify health insurance.

For Health Insurance Providers: Efficiency, Savings, and Growth

- Improved Operational Efficiency. Automating repetitive tasks like data entry, initial claims review, and basic customer queries frees up human staff for more complex, value-added activities. AI for health insurance drives significant internal improvements.

- Cost Reduction. Lower call center volumes, reduced manual processing errors, and more effective fraud detection contribute to substantial cost savings.

- Enhanced Member Retention and Loyalty. A superior customer experience in health insurance is a powerful driver of loyalty, reducing churn and the associated costs of acquiring new members.

- Data-Driven Decision Making. AI provides deep insights into member behavior, risk profiles, and operational bottlenecks, enabling more informed strategic decisions.

- Competitive Differentiation. Insurers that leverage AI in health insurance to enhance customer experience will gain a significant edge in a crowded market.

- Better Risk Management. More accurate underwriting and proactive identification of health risks lead to a healthier member base and more predictable claim costs.

As Statista research indicates, the global AI in healthcare market is projected to grow exponentially, underscoring the industry’s confidence in AI’s transformative potential, including its impact on customer experience in health insurance.

Challenges of AI Implementation for Better Customer Experience

While the benefits of AI in health insurance are compelling, the journey to successful implementation is not without its hurdles. Proactively addressing these challenges is crucial for realizing AI’s full potential in health insurance and boosting customer experience.

Key Considerations and Potential Obstacles

- Data Privacy and Security. Health insurance data is highly sensitive. When implementing AI solutions, insurers must ensure robust security measures and compliance with regulations like HIPAA (in the US) or GDPR (in Europe). Any breach could severely damage trust and negate efforts to improve the customer experience in health insurance.

- Integration with Legacy Systems. Many established insurers operate on older IT infrastructure. Integrating new AI platforms with these legacy systems can be complex, costly, and time-consuming.

- Cost of Implementation. The initial investment in AI technology, talent, and training can be substantial. A clear ROI strategy is needed.

- Algorithmic Bias and Fairness. AI models are trained on data, and if that data reflects existing biases, the AI can perpetuate or even amplify them. That could lead to unfair outcomes in areas like risk assessment or claim approval, negatively impacting the customer experience in health insurance for specific demographics. Rigorous testing and diverse datasets are essential.

- Change Management and Workforce Upskilling. Employees may be resistant to changes brought by AI, fearing job displacement. Insurers must invest in training and upskilling their workforce to collaborate with AI tools and focus on higher-value tasks requiring human empathy and complex problem-solving. The human touch remains vital for a positive customer experience in health insurance.

- Maintaining the Human Touch. While AI can handle many interactions, there are times when customers need empathy and human understanding that AI cannot (yet) fully replicate. Striking the right balance between automation and human interaction is key to a successful customer experience in health insurance. For this reason, Gartner often emphasizes the importance of “human-centric AI.”

- Regulatory Compliance and Explainability. Some AI algorithms, intense learning models, can be “black boxes,” making it difficult to understand how they arrive at a decision. That can be problematic for regulatory compliance and explaining decisions to customers, potentially harming the customer experience in health insurance if a decision feels arbitrary.

Strategies for Successful AI Integration

Overcoming these challenges requires careful planning and a strategic approach to deploying AI for health insurance.

- Start Small and Scale. Begin with pilot projects in specific areas (e.g., a chatbot for FAQs) to demonstrate value and learn before a full-scale rollout. That allows for refinement and builds confidence.

- Prioritize Data Governance. Implement strong frameworks to ensure data quality, security, and privacy from the outset. Trust in AI in health insurance is foundational.

- Focus on User-Centric Design. Design AI solutions with the end-user, customers and employees in mind. Ensure interfaces are intuitive and that the technology genuinely solves their problems. A good user interface is critical for a positive customer experience in health insurance.

- Invest in Talent and Training. Develop in-house AI talent or partner with experienced vendors. Provide comprehensive training to employees to help them adapt to new roles and tools.

- Ensure Transparency and Explainability. Where possible, use interpretable AI models. Develop mechanisms to explain AI-driven decisions to customers in clear, simple language. This transparency is vital for maintaining trust and a good customer experience in health insurance.

- Adopt a Hybrid Approach. Combine AI with human oversight. For example, AI can handle initial query screening, with complex issues seamlessly escalated to human agents who have the full context. This blended approach often delivers the best customer experience in health insurance.

- Continuously Monitor and Iterate. AI solutions are not “set and forget.” Continuously monitor their performance, gather feedback, and make improvements to ensure they remain effective and aligned with customer needs and business goals. The customer experience in health insurance is an evolving target.

By thoughtfully navigating these considerations, health insurance providers can unlock AI’s immense potential to create a truly customer-centric organization.

The Future is Here: AI-Driven Customer Experience in Health Insurance is the New Norm

The trajectory is clear: AI in health insurance is moving from a niche innovation to a core service delivery component. The future of customer experience in health insurance will be inextricably linked with the intelligent application of AI. We are entering the era where hyper-personalization, proactive engagement, and seamless interactions become standard expectations.

Emerging Trends and Future Outlook

- Hyper-Personalization at Scale. AI will enable insurers to understand individual member needs and preferences with unprecedented granularity. This will lead to dynamically customized plans, communications, and wellness advice, making every customer experience in health insurance feel unique.

- Predictive and Prescriptive Analytics for Proactive Care. Beyond identifying risks, future AI for health insurance will offer more prescriptive guidance, helping members take specific actions to prevent illness or manage chronic conditions more effectively. This focus on prevention will be a hallmark of an evolved customer experience in health insurance.

- AI-Powered Mental Health Support. AI tools, such as chatbots trained in cognitive behavioral therapy techniques, will play a greater role in providing accessible, initial support for mental health concerns, complementing traditional care.

- Voice AI and Conversational Interfaces. Voice assistants and more sophisticated conversational AI will make interacting with health insurance providers more natural and intuitive. Imagine managing your policy or asking complex questions simply by talking to your smart speaker or phone. This ease of use will redefine customer experience in health insurance.

- AI in Value-Based Care Models. AI will be instrumental in analyzing patient outcomes and costs, supporting the shift towards value-based care models that reward providers for keeping patients healthy rather than just treating sickness. That ultimately benefits the member and their customer experience in health insurance.

- Ethical AI Frameworks and Governance. As AI becomes more pervasive, there will be an increased focus on developing and adhering to robust ethical frameworks to ensure fairness, transparency, and accountability in AI in health insurance.

The journey towards an AI-augmented customer experience in health insurance is not just about adopting new technologies; it’s about reimagining the entire member relationship. It’s about building a system where the health insurance provider is a trusted partner in the member’s health and financial well-being.

Final Thoughts

For health insurance companies, the decision is no longer whether to adopt AI, but how quickly and effectively they can integrate it to enhance the customer experience in health insurance. Those lagging behind risk become obsolete in an increasingly demanding and technologically advanced market. The benefits – from improved member satisfaction and retention to operational efficiencies and better health outcomes – are too significant to overlook.

Escaping AI means risking competitive disadvantage, operational inefficiencies, and a failure to meet the evolving expectations of today’s digitally savvy consumers. The future of customer experience in health insurance is intelligent, personalized, and proactive, and AI is the engine driving this transformation. Embracing AI for health insurance is not just an option; it’s essential for survival and success.

The path to an AI-enhanced customer experience in health insurance can seem complex. The SPsoft team specializes in leveraging AI and delivering tangible results that elevate member satisfaction and operations!

FAQ

How is AI currently changing the customer experience in health insurance?

AI is making the customer experience in health insurance faster, more personalized, and more accessible. This includes 24/7 support via chatbots, personalized plan recommendations, quicker claims processing through automation, and proactive health and wellness advice based on individual data.

What are the biggest benefits of using AI for health insurance providers?

Key benefits include improved operational efficiency, significant cost reductions (e.g., in call centers and claims processing), enhanced member retention due to better customer experience in health insurance, more accurate risk assessment, and a stronger competitive advantage in the market.

Will AI replace human agents in health insurance customer service?

Not entirely. AI in health insurance is designed to augment human capabilities, not replace them. AI can handle routine queries and tasks, freeing up human agents to manage complex issues that require empathy and nuanced understanding, thus optimizing the overall customer experience in health insurance.

Is my personal health information safe when health insurers use AI?

Reputable health insurance companies and their AI solution providers prioritize data security and comply with strict regulations like HIPAA or GDPR. AI systems are built with robust security measures to protect sensitive health information. Always verify your insurer’s privacy policies.

Can AI help me choose the best health insurance plan for my needs?

AI for health insurance can analyze your specific circumstances, health status, and preferences to recommend plans that are most suitable for you. This makes the selection process less confusing and contributes to a better initial customer experience in health insurance.

What is “algorithmic bias” in AI for health insurance, and why is it a concern?

Algorithmic bias occurs if the data used to train an AI model reflects existing societal biases. This could lead to unfair treatment of certain demographic groups in areas like premium pricing or access to care. Ethical AI development and diverse data are crucial to mitigate this and ensure a fair customer experience in health insurance for everyone.

How can AI make the health insurance claims process less frustrating?

AI in health insurance can automate many aspects of claims submission and review, leading to much faster processing times. It can also provide real-time status updates, reduce errors, and flag potentially fraudulent claims more efficiently, all of which improve the customer experience in health insurance during a critical moment.

What does the future hold for AI in shaping the customer experience in health insurance?

The future points towards hyper-personalization, where your health insurance offerings and interactions are uniquely tailored to you. Expect more proactive health management driven by predictive analytics, greater use of voice AI for easier communication, and an overall more seamless and intuitive customer experience in health insurance.

How can small to medium-sized health insurance providers adopt AI without massive upfront costs?

Smaller providers can start with scalable, cloud AI solutions, focusing on specific high-impact areas like AI chatbots for customer service or AI tools for claims pre-assessment. Partnering with experienced AI vendors like SPsoft can also provide cost-effective access to expertise and technology, enabling them to improve their customer experience in health insurance.

Beyond efficiency, how does AI contribute to a more empathetic customer experience in health insurance?

By automating routine tasks, AI for health insurance frees up human staff to focus on complex interactions requiring empathy. AI can also analyze customer sentiment in communications, helping insurers identify and address member dissatisfaction more proactively, thus fostering a more understanding and supportive customer experience in health insurance.