From retail to finance, AI’s ability to analyze data, automate processes, and generate insights is driving unprecedented change. The health insurance sector, facing mounting pressures from rising healthcare costs, evolving expectations for personalized experiences, and navigating complex regulatory landscapes, is ripe for this AI transformation. Thus, the integration of AI in health insurance is rapidly moving from a competitive advantage to a strategic necessity.

But what is the actual role of AI health insurance? AI health insurance is not a single piece of technology but an umbrella term for a collection of advanced computational tools. These include Machine Learning (ML), Natural Language Processing (NLP), predictive analytics, computer vision, and Robotic Process Automation (RPA) enhanced with cognitive capabilities.

These techs are applied across the health insurance value chain to analyze vast datasets, automate manual tasks, and personalize interactions with members and providers. Ultimately, this helps insurers improve their decision-making. The significance of AI in health insurance is growing exponentially as organizations recognize its potential to address core challenges.

The health insurance industry traditionally grapples with significant hurdles. That covers high administrative costs associated with manual processing, the pervasive issue of fraud, waste, and abuse, the complexity of accurately assessing and pricing risk, etc. These very challenges, however, present clear opportunities for AI intervention. AI in health insurance offers robust solutions to streamline operations, detect fraud more effectively, refine risk models, and deliver the tailored experiences customers now expect. So, this article will explore AI’s multifaceted applications, tangible benefits, inherent challenges, and future trajectories in health insurance.

SPsoft specializes in developing and integrating AI solutions that streamline processes and automate workflows. Contact us to discover how we can implement AI to enhance claims processing!

4 Most Critical Use Cases of AI in Health Insurance

The application of AI within the health insurance sector is remarkably diverse, influencing nearly every operational facet and strategic function. Understanding the specific AI use cases in health insurance is fundamental to grasping the tech’s profound transformative power. From initial risk assessment to ongoing member engagement, AI is creating new efficiencies and capabilities.

Underwriting and Risk Assessment

Traditional health insurance underwriting often involves manual review processes, relies on limited historical data points, and can be susceptible to inherent biases. That can lead to broad, less precise risk categories and potentially inaccurate premium pricing. However, AI algorithms, particularly machine learning models, can ingest and analyze significantly more extensive and more varied datasets than human underwriters alone. That includes:

- Structured data like claims history and demographics

- Potentially unstructured data sources like physician notes (using NLP)

- Data from wearables and health apps (where ethically permissible and consented to by the member)

By identifying subtle patterns and correlations within this data, AI enables far more accurate risk stratification and predictive modeling. That allows insurers to price policies more accurately based on a deeper understanding of individual and group risk profiles.

This enhanced analytical capability leads to greater precision in defining risk pools. Instead of broad categories, AI facilitates micro-segmentation, identifying nuanced risk factors across diverse data streams. While this allows for pricing that more accurately reflects individual risk, potentially benefiting lower-risk individuals, it also introduces critical ethical considerations.

Without careful governance and regulatory oversight, such hyper-segmentation could make insurance unaffordable for those identified as high-risk. This could potentially undermine the fundamental insurance principle of pooling risk across a population. Therefore, the power of AI in risk assessment must be balanced with a commitment to fairness and accessibility. Ultimately, more accurate pricing driven by AI contributes to improved financial performance for insurers by reducing adverse selection and ensuring premiums align better with expected costs.

Personalized Policy Creation and Recommendations

The era of one-size-fits-all health insurance plans is fading, replaced by a growing demand for personalization. AI is a key enabler of this shift. By checking an individual’s health profile, stated preferences, and lifestyle information and anticipating potential future healthcare needs based on predictive analytics, AI helps tailor insurance products.

AI algorithms can recommend specific plans, riders, or coverage levels that best match a member’s circumstances. Furthermore, AI can facilitate more dynamic policy adjustments. For instance, data from wellness program participation or significant life events could trigger reviews or suggestions for policy modifications, ensuring coverage remains relevant.

This capability moves beyond traditional insurance’s static annual renewal cycle. The constant analysis enabled by AI supports the emergence of a so-called “living policy” that can adapt more fluidly to a policyholder’s evolving health status, behaviors, and life circumstances. That fosters a more continuous and collaborative relationship between the insurer and the insured, moving towards a data-driven partnership. Such a dynamic approach could enhance customer loyalty and satisfaction. Still, it hinges critically on robust data governance, absolute transparency with members about how their data is used, and maintaining trust.

Operational Efficiency Enhancement

The administrative burden in the insurance industry is substantial and consumes significant resources. AI technologies, particularly RPA, often augmented with AI capabilities like NLP and computer vision, are proving highly effective at alleviating this burden. These tools can automate many repetitive, rules-based tasks previously performed manually.

Examples include:

- Data Entry. Automatically extract information from forms and enter it into systems.

- Eligibility Verification. Quickly checking member eligibility for services against policy databases.

- Document Processing. Sorting, classifying, and routing digital or scanned documents.

- Basic Query Handling. Using chatbots to answer routine questions, freeing up human agents.

Beyond task automation, AI optimizes internal workflows by analyzing process bottlenecks and suggesting improvements or dynamically allocating resources based on predicted workloads.

The impact of this automation extends beyond mere cost reduction. While lowering operational expenses is a primary driver, automating mundane tasks liberates human employees. This shift allows skilled personnel to focus on more complex, strategic, value-added activities requiring human judgment, empathy, and critical thinking. Such activities include managing intricate claims investigations, creating innovative products, and strengthening customer relationships.

In this way, operational efficiency achieved through AI in health insurance is a key catalyst. It enables the organization to redirect its most valuable resource — people — towards activities that drive tremendous growth and differentiation within the health insurance industry.

Preventative Care and Wellness Programs

There is a growing recognition that investing in preventative health and wellness leads to better long-term health outcomes for members and cost savings for insurers. AI plays a pivotal role in making these programs more effective and personalized.

AI algorithms analyze integrated datasets, including claims history, data from wearable fitness trackers, health app usage, and demographic information. That helps identify individuals at higher risk for developing specific chronic conditions like diabetes or heart disease. Early identification allows for proactive intervention.

These insights allow AI to power personalized outreach and support through various channels. That could involve:

- Sending tailored health recommendations and tips via a mobile app

- Delivering reminders for necessary health screenings or vaccinations

- Creating personalized wellness challenges or goals within corporate wellness programs

- Using chatbots to answer FAQs about healthy habits or available preventative services

AI-driven preventative care initiatives improve population health trends by engaging members proactively and providing support for managing their health. This reduces the long-term cost burden associated with chronic diseases, benefiting individuals and insurers.

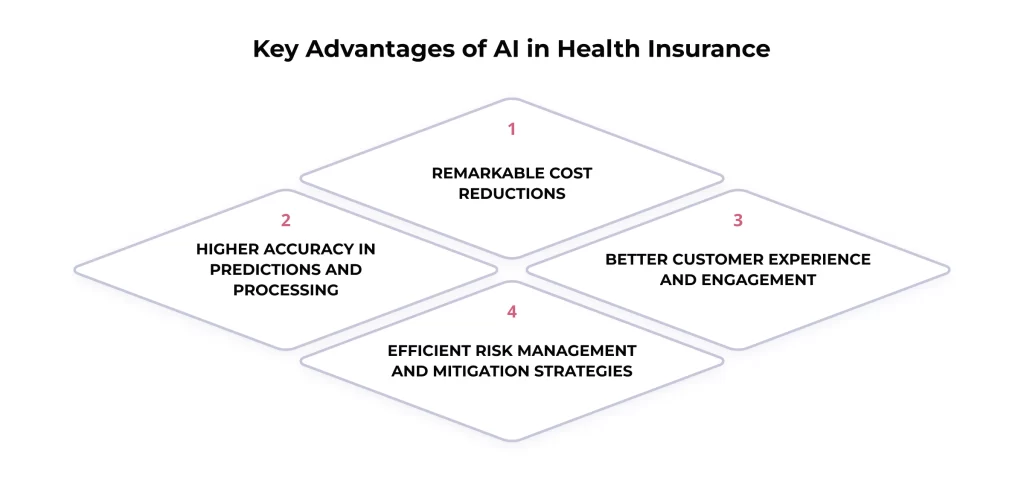

Tangible Benefits of AI in Health Insurance to Consider

Implementing AI yields significant, measurable advantages that benefit insurers, providers, and policyholders alike, fundamentally improving how the industry operates and serves its members.

Remarkable Cost Reductions

One of AI’s most immediate and impactful benefits in health insurance is its potential for substantial cost savings across multiple operational areas.

- Automation. AI and RPA automate labor-intensive manual tasks like claims processing, data entry, and customer inquiries, reducing labor costs and administrative overhead.

- Fraud Prevention. Sophisticated AI algorithms are far more effective than traditional methods at detecting and preventing fraudulent claims, saving insurers from financial losses. The cost of healthcare fraud is substantial, estimated to be tens of billions of dollars annually in the US alone, making AI-driven detection a critical cost-containment tool. According to some industry estimates, AI has the potential to save the insurance sector billions globally through enhanced efficiency and fraud reduction.

- Accurate Underwriting. More precise risk assessment and pricing enabled by AI reduce the financial burden associated with mispriced risks and adverse selection.

- Streamlined Claims. Faster, automated claims processing lowers the administrative cost per claim.

These cost-saving mechanisms do not operate in isolation; they create a positive feedback loop. Reduced losses from fraud free up capital. Lower operational costs derived from automation directly improve profit margins. A healthier risk pool resulting from more accurate underwriting stabilizes the financial base. These factors compound, strengthening the insurer’s overall financial health. Such improved financial standing can then be reinvested into further tech innovation, enhanced member benefits, or potentially lead to more competitive premium pricing.

Higher Accuracy in Predictions and Processing

Beyond cost savings, AI introduces higher accuracy to core insurance functions. Machine learning models consistently perform better than traditional statistical methods in various predictive tasks. That includes:

- Predicting future claim costs for individuals or groups

- Identifying patients at high risk for hospital readmissions or specific health conditions

- Forecasting policy lapse rates

- Estimating the potential success of wellness interventions

Furthermore, automation reduces the potential for human error in data-intensive processes like claims adjudication and payment calculation. Manual data entry mistakes, misinterpretations of policy rules, or calculation errors can be minimized when AI systems handle routine processing based on predefined logic and learned patterns.

This enhanced accuracy translates directly into better, more reliable decision-making across the entire organization, from setting appropriate premiums to ensuring more accurate payments.

Better Customer Experience and Engagement

In today’s competitive market, customer experience is a key differentiator. AI in health insurance provides the tools to deliver personalized and proactive services that modern clients expect.

- Personalization at Scale. AI analyzes individual member data to tailor communications, recommendations, and interactions, making them more relevant and valuable.

- Instantaneous Support. AI-powered chatbots and virtual assistants provide 24/7 answers to common questions and guide users through simple processes, reducing wait times compared to traditional call centers.

- Proactive Outreach. Based on data analysis, AI can trigger proactive communications, such as reminders for preventative screenings, personalized wellness tips, or alerts about relevant plan benefits, fostering ongoing engagement.

The drive towards AI-powered personalization is also fueled by evolving consumer behavior. Individuals are increasingly accustomed to personalized experiences delivered by AI in sectors like e-commerce and streaming services. They bring these expectations to their interactions with health insurers. Consequently, leveraging AI for a superior customer experience rapidly shifts from a ‘nice-to-have’ feature to a fundamental requirement for customer acquisition and retention. Insurers failing to adopt AI for personalization risk falling behind competitors and losing members seeking more tailored and responsive services.

Efficient Risk Management and Mitigation Strategies

Effective risk management is the bedrock of the insurance business. AI enhances an insurer’s ability to identify, assess, price, and manage risk throughout the policy lifecycle. Beyond initial assessment, AI enables ongoing risk monitoring. Algorithms can analyze population health data to detect emerging health trends or potential outbreaks, allowing for proactive planning.

They can also identify claims patterns that may indicate potential large losses early on, enabling timely intervention or reserve adjustments. Besides, by automating processes and embedding compliance checks within workflows, AI helps mitigate operational risks associated with manual errors or non-adherence to regulations.

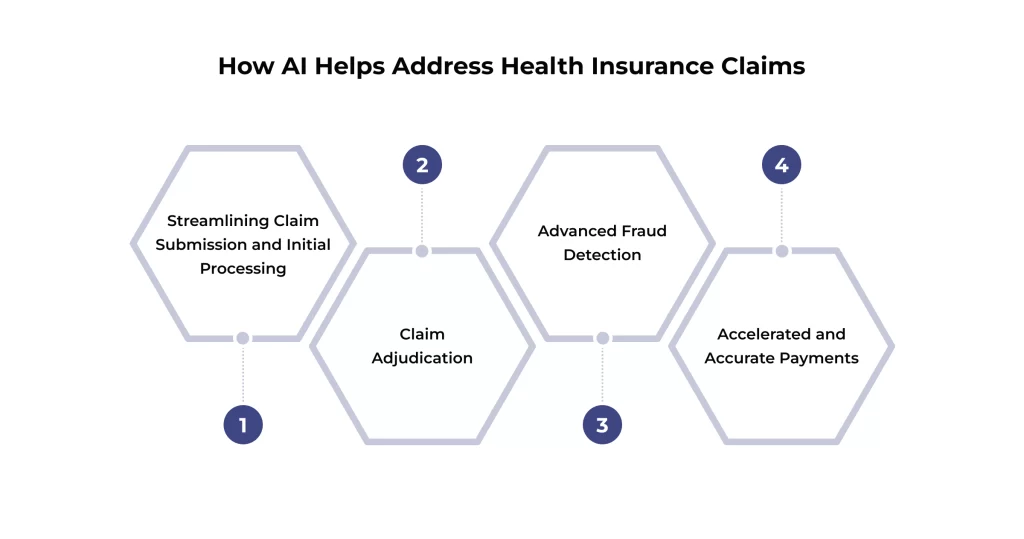

Leveraging AI to Address Health Insurance Claims

The claims process sits at the heart of the health insurance operation. It is a critical touchpoint for members and providers, but manual effort, potential delays, and administrative costs have traditionally characterized it. So, the adoption of AI in health insurance claims represents one of the most impactful areas of transformation, promising incredible speed, accuracy, and efficiency.

Streamlining Claim Submission and Initial Processing

The claims journey often begins with submitting forms, which can arrive in various formats – digital uploads, emails, or scanned paper documents. AI technologies like NLP and Computer Vision, specifically Optical Character Recognition (OCR), can automate the initial intake process. These tools can ‘read’ and extract relevant data directly from submitted forms, drastically reducing the need for manual data entry.

AI can also perform initial validation checks at the point of submission. It can verify if required fields are complete, check for basic formatting errors, or cross-reference submitted codes against standard libraries. This early-stage validation can reduce the number of claims rejected due to simple errors, minimizing rework and follow-up queries for insurers and submitters.

Claim Adjudication

Claim adjudication (determining whether a claim is payable based on policy coverage, member eligibility, medical necessity, coding accuracy, and provider contracts/fee schedules) is often complex and time-consuming. AI systems can automate large portions of this critical function for standard, straightforward claims.

Machine learning models and rules engines can instantly compare claim data against millions of policy rules, clinical guidelines, and contractual agreements. AI can automatically approve clean claims that meet all criteria or flag claims with discrepancies or complexities for human review. That creates an efficient hybrid model: AI handles the high volume of routine claims quickly, while complex, ambiguous, or sensitive claims are routed to experienced human adjusters. These possess the necessary nuanced judgment and investigative skills.

Such automation alters the nature of the claims adjuster’s job. Rather than spending most of their time on routine processing of simple claims, AI enables adjusters to operate at a higher level. Their focus shifts towards:

- Managing exceptions

- Investigating complex scenarios

- Interpreting ambiguous policy language

- Communicating with providers and members on sensitive issues

- Making judgments that require empathy and a deep understanding of context

The capabilities mentioned above represent where AI currently lags. This elevates the human role from repetitive task execution to complex problem-solving and relationship management, requiring ongoing training and skill development for claims professionals.

Advanced Fraud Detection

Health insurance fraud, waste, and abuse represent a massive financial drain on the system, contributing to rising healthcare costs. Traditional fraud detection methods rely on predefined rules and manual audits, which struggle to keep pace with increasingly sophisticated fraudulent schemes. AI in health insurance claims offers a powerful countermeasure.

AI algorithms excel at analyzing vast interconnected datasets, including claims data, provider profiles, patient histories, billing patterns, and external data sources. By learning standard behavior patterns, AI identifies subtle anomalies, suspicious connections, and complex fraudulent activities that rule-based systems typically miss. Examples include:

- Upcoding. Billing for more expensive services than were provided.

- Phantom Billing. Billing for services never rendered.

- Identity Theft. Using stolen patient information to submit false claims.

- Collusion. Identifying networks of providers and patients collaborating on fraudulent schemes.

- Unbundling. Billing separately for services typically bundled together.

This ability to analyze data at scale and detect hidden patterns represents a great leap forward in fraud management. Traditional approaches are often reactive, investigating suspicious claims after they have been flagged or even paid out, leading to costly ‘pay and chase’ scenarios.

In contrast, AI facilitates a more proactive stance. By identifying red flags and suspicious patterns during the claims submission or adjudication process, AI often prevents fraudulent payments from being issued in the first place. AI’s major strategic advantage in health insurance claims is shifting from post-payment recovery efforts to pre-payment prevention.

Accelerated and Accurate Payments

The combined effect of automated intake, AI-powered adjudication, and reduced manual intervention dramatically accelerates the claims lifecycle. Simple, clean claims that might have taken weeks or months to process manually can be adjudicated and approved within days or hours. This faster turnaround time translates into quicker payments for providers, improving the cash flow, and faster resolutions for members regarding financial responsibility.

Simultaneously, automation enhances accuracy. By minimizing manual data handling and applying rules consistently, AI reduces the errors often associated with human processing, such as typos, misinterpretations, or calculation mistakes. That leads to more accurate payments and fewer disputes arising from processing errors, benefiting all parties involved.

Personalizing Customer Service through AI in Health Insurance

In the highly competitive health insurance marketplace, providing exceptional customer service is critical for differentiation and member retention. AI offers powerful tools to transform client interactions, making them more responsive, personalized, efficient, and satisfying.

AI-Powered Chatbots and Virtual Assistants for Instant Support

One of the most visible applications of AI in customer service is the deployment of chatbots and virtual assistants on insurer websites and mobile applications. These AI-driven tools leverage NLP to understand customer queries, whether typed or spoken. They can provide immediate, 24/7 answers to a wide range of common questions, such as:

- Checking the status of a claim

- Verifying coverage details for a specific service

- Finding in-network healthcare providers

- Explaining deductibles or copayments

By offering instant responses, chatbots eliminate the frustrating wait times often associated with traditional call centers, significantly improving customer satisfaction for routine inquiries. They can also guide users through simple processes like updating contact information or submitting basic forms. When a query is too complex or requires human empathy, the chatbot can escalate the interaction to a human agent, providing the agent with the context of the conversation so far.

Personalized Communication and Member Engagement

AI enables insurers to move beyond generic, mass communication toward highly personalized member engagement strategies. It can develop a deep understanding of individual needs and preferences by analyzing a wealth of member data, such as demographics, health history, past interactions, plan details, and data from wellness programs.

This understanding allows insurers to tailor communications and outreach efforts. Examples include:

- Sending personalized reminders for age-appropriate preventative screenings or necessary follow-up appointments

- Providing targeted wellness tips and resources relevant to a member’s health conditions or goals

- Notifying members about underutilized plan benefits that could be valuable to them

- Proactively seek support or information based on predicted healthcare needs or life events

This level of personalization makes interactions feel more relevant and valuable to the member, fostering a stronger sense of engagement and partnership with their insurer. That encourages healthier behaviors and leads to better health outcomes.

AI Assistance in Plan Selection and Understanding

Choosing the right health insurance plan can be daunting for consumers. This often involves navigating complex terminology, comparing numerous options with subtle differences, and trying to predict future healthcare needs. AI acts as a powerful decision-support tool in this process.

AI-powered tools, often integrated into websites or apps, function like virtual advisors. They can ask users targeted questions about their health status, anticipated medical needs, budget limits, preferred doctors or hospitals, and risk tolerance. Based on the responses, the AI can analyze available options, filter out unsuitable ones, and recommend a shortlist of plans that best align with the individual’s specific circumstances.

Furthermore, AI (using NLP) can help simplify complex insurance jargon, explain policy details in plain language, and clearly highlight the key differences between various plans.

Final Thoughts

AI integration is undeniably reshaping the landscape of the health insurance industry. As we have explored, AI in health insurance delivers tangible benefits across the value chain. It drives significant operational efficiencies through automation and substantially reduces costs via enhanced processing and sophisticated fraud detection. Besides, AI improves accuracy in everything from underwriting to claims payment and elevates the customer experience through personalization and responsive service. AI’s impact is profound and multifaceted.

Looking ahead, AI’s journey in the health insurance industry is far from over. Emerging trends suggest even greater integration and sophistication. We anticipate advancements in AI-driven predictive diagnostics, potentially identifying disease risk even earlier.

Hyper-personalization will likely become more refined, tailoring not just recommendations but aspects of coverage itself (within ethical and regulatory limits). The seamless integration of IoT devices and wearable data could enable real-time health monitoring and dynamic interventions. Furthermore, AI will support the shift towards value-based care models, helping measure outcomes and identify effective treatment pathways. As highlighted, AI’s analytical power will also increasingly inform the design of innovative, flexible, and member-centric health plans.

In conclusion, AI in health insurance represents a fundamental paradigm shift. It is accelerating the transition towards a health insurance ecosystem that is more efficient, data-driven, personalized, and proactive. For insurers aiming to thrive in an increasingly complex and competitive environment, strategically embracing and responsibly implementing AI is no longer optional. It is key to shaping a healthier future for their business and their members. The evolution is continuous, and the potential for positive transformation remains immense.

Our expertise in AI development and integration enables us to create solutions that personalize interactions and improve customer satisfaction. Contact us to transform your customer engagement in the medical sector!

FAQ

Is AI replacing human agents in health insurance?

AI is not poised for a complete replacement of human agents but rather a transformation of their roles. AI excels at automating high-volume, repetitive tasks, processing data rapidly, and providing instant answers to standard questions. That frees up human agents from routine work.

However, humans remain indispensable for tasks requiring empathy, complex problem-solving, nuanced judgment, building rapport, and handling sensitive or emotionally charged situations. The emerging model is collaboration, where AI handles the predictable and automatable, allowing human agents to focus on higher-value, complex interactions requiring a human touch. This synergy aims to enhance overall efficiency and service quality.

How does AI detect fraudulent claims?

AI employs sophisticated techniques like ML and anomaly detection to sift through massive volumes of claims data, provider information, and patient histories. Unlike traditional systems relying on fixed rules, AI learns complex patterns associated with legitimate claims activity. It then identifies deviations, outliers, and inconsistencies that signal potential fraud.

That could involve:

– Spotting unusual billing code combinations

– Detecting providers submitting statistically improbable numbers of claims

– Identifying networks of colluding individuals

– Flagging claims with mismatched patient or provider details

AI’s ability to analyze data relationships at scale allows it to uncover intricate fraud schemes that might otherwise go unnoticed.

Will AI make the claims process faster and more accurate?

Yes, substantially. AI in health insurance claims directly addresses bottlenecks in the traditional process. AI dramatically cuts down processing times by automating tasks like data extraction from forms, initial validation checks, and adjudicating standard claims against policy rules.

Besides, by reducing manual data entry and intervention, AI minimizes the risk of human error (e.g., typos and misinterpretations), leading to more accurate claim assessments and payments. That benefits providers with faster payment and members with quicker resolution.

Can AI help me choose the best insurance plan?

Yes, AI can serve as a valuable tool during plan selection. AI-powered platforms can guide you through questions about your health status, expected healthcare usage, budget, preferred doctors, and other priorities. Based on your input, the AI can analyze the features, costs, and provider networks of various available plans and then recommend the options that appear to best fit your specific needs. These tools can also help demystify complex insurance terminology, making it easier to compare plans effectively.

Does AI offer personalized coverage recommendations?

Yes, personalization is a key strength of AI in health insurance. AI can move beyond generic plan recommendations by analyzing your individual data (always with appropriate consent and adhering to privacy regulations). It can:

– Identify potential gaps in your current coverage based on your health profile or lifestyle

– Suggest specific riders or supplemental policies that might be beneficial

– Highlight plan features that align particularly well with your anticipated healthcare needs

That allows for more tailored coverage suggestions compared to traditional approaches.

How is my personal data protected when AI is involved?

Protecting personal health information (PHI) is a top priority and a legal mandate for health insurers using AI. Several layers of protection are employed:

– Regulatory Compliance. Strict adherence to regulations like HIPAA in the US, which sets rigorous standards for the privacy and security of PHI.

– Cybersecurity Measures. Implementing robust technical safeguards, including strong encryption for data at rest and in transit, strict access controls, firewalls, intrusion detection systems, and regular security audits.

– Data Privacy Principles. Adherence to principles like data minimization (collecting only necessary data), purpose limitation (using data only for stated reasons), and transparency (informing you how data is used).

– Anonymization/De-identification. Using techniques to remove personal identifiers from data used for AI training or analysis whenever feasible.

– Vendor Management. Ensuring third-party AI partners meet strict security and privacy standards through contractual agreements (BAAs). Reputable insurers invest heavily in these measures to safeguard your data and maintain trust.

Can AI help insurers design better, more flexible health plans?

Yes, AI has significant potential in product development. AI can generate:

– Valuable insights by analyzing aggregated, anonymized data on population health trends

– The effectiveness of different treatments and interventions

– Member feedback

– Claim patterns on a large scale

Such insights can help insurers identify unmet needs, understand which plan features are most valued or effective, and predict the potential impact of new plan designs. This data-driven approach can create more innovative, flexible, and customer-centric health plans. They feature elements of dynamic personalization, integrated wellness incentives, or coverage better aligned with emerging healthcare delivery models like value-based care.